COVID-19 Impacts on Business: Survey Results

Since Covid hit in early March, AIA Vermont has sent out two surveys to our members, one in the spring and then a second in late summer. Both surveys included the same questions and were intended to track how businesses were being impacted by the pandemic over a span of months. The first survey had a strong response, with over 60 firms filling it out. The results of that survey can be seen here.

The second survey had a much lower response rate, with just over 20 firms responding. With such a small sample of firms responding, the results of the second survey were inconclusive. It cannot be seen as a broad representation of our membership at this time.

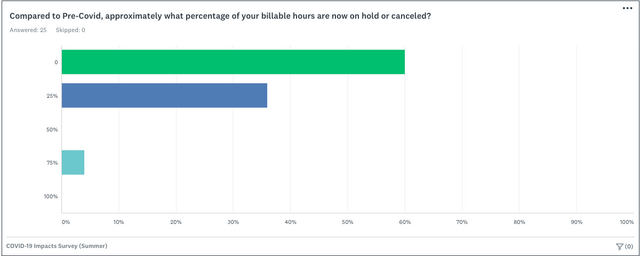

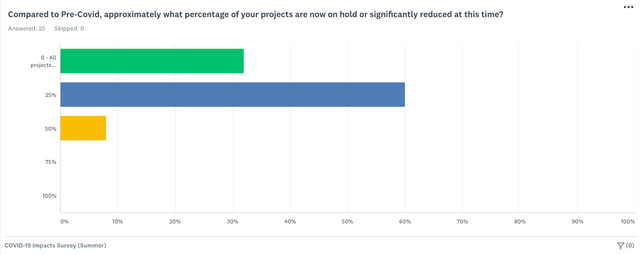

Those firms who did fill out the survey provided us some insights into how their firms are faring. When asked what percentage of billable hours are now on hold or cancelled (compared to pre-COVID), 60% of respondents said zero, and approximately 35% responded that about a quarter of billable hours are now on hold or cancelled. Less than 5% of respondents said that 75% of billable hours are now on hold or cancelled. A larger percentage of firms (approximately 60% of respondents) said that a quarter of their projects are now on hold or significantly reduced, with another 35% saying that none of their projects are on hold, and a small minority (less than 10%) reported that about half of their projects are on hold or reduced.

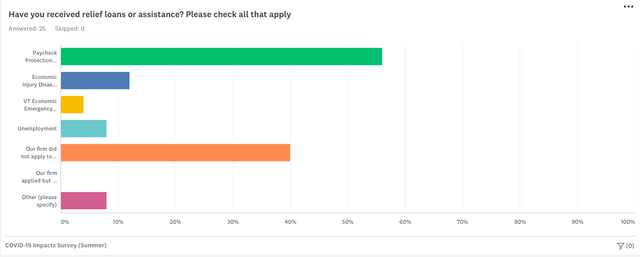

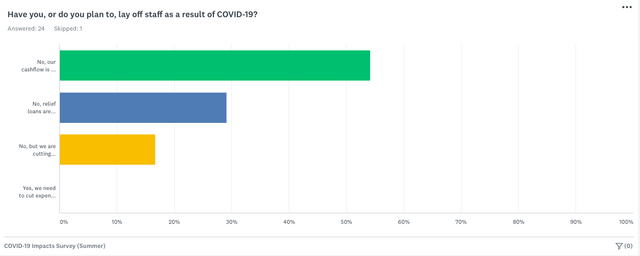

Fortunately, all of the respondents reported that, at the time of taking the survey, there had been no layoffs in response to COVID, but a small number of firms (16%) have reported needing to cut salaries to stay afloat. When it comes to relief loans or assistance, 56% of responding firms received funds from the Paycheck Protection Program, with smaller percentages of respondents reporting receiving funds from other assistance programs (such as EIDL’s, VT Economic Emergency Recovery Grants, unemployment, or other). Approximately 40% of firms reported that they did not apply for any assistance or relief funds.

Ultimately, the responses to this survey, combined with the conversations I’ve had with members, lead me to have the impression that those firms who do residential work have been kept quite busy, while firms who focus more on commercial work took a harder hit this spring and summer. While commercial projects have begun to come back online, there isn’t the same boom as there has been in the residential market.

This all of course begs the question- What are you seeing? Do the survey results match your experience, or are they vastly different? Are you a residential firm that is struggling to find work? Or a commercial firm that can’t keep up with the amount of work coming in? Please let us know.